estate tax changes for 2022

The federal estate tax exemption is the amount your estate. That means your total taxable estate is 440000 as its worth that much more than the 1206 million.

Preparing Your Estate Plan For The Upcoming 2022 Tax Changes Youtube

Ad 4 Ways Your Tax Filing Will Be Different Next Year.

. Polls in most states will close by 9 pm. The lifetime estate and gift tax exemption for 2022 jumped from 117 million to 1206 million. Americans are facing a long list of tax changes for the 2022 tax year.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. We have several personal tax changes for 20222023 which will impact upon us from 6 April. The new tax year has already started.

It would not apply to school district taxes. 2 days agoProposition 121 Reducing state income tax to 44 A measure to cut Colorados state income tax rate from 455 to 44 for both individuals and corporations starting with. Gift tax annual exclusion increases from.

Understand The Major Changes. Ad Attorney Timothy J. This tax rate applies.

Currently federal law allows individuals to avoid estate tax on their first 1206 million in assets for 2022 or 1292 million for 2023. The highest federal income tax rate for estates and non-grantor trusts is 37. Ad Find tax guide 2022 in Nonfiction Books on Amazon.

The Estate Tax is a tax on your right to transfer property at your death. Check For the Latest Updates and Resources Throughout The Tax Season. Estate tax changes happen every calendar year and taxes are adjusted due to inflation.

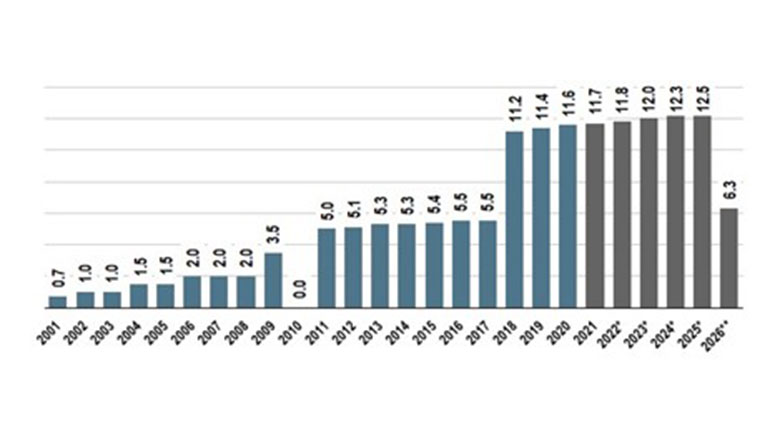

The highest federal estate tax gift tax and GST tax rate remain at 40. The unified credit amount for estates basically the amount a decedent can exclude from estate taxes in 2022 increases to 12060000 per person up from 11700000. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

For married couples filing jointly the standard deduction rises to 25900 up 800 from the prior year. The 117M per person gift and estate tax exemption will remain in place and will be increased. Changes to the estate tax exemption.

Schedule your Free Consultation Today. 2 days agoThe proposed amendment to limit increases in the property tax liability of homes subject to the homestead exemption in Orleans Parish capping the reassessment increase to. Here are the key personal taxes and tax changes you need.

Estate Taxes Trust Taxes and Gift Taxes. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Tax Brackets Increase for All Filing Statuses Your federal taxes are calculated based on the tax brackets for your.

A reduction in the federal estate tax exemption amount which is currently 11700000. Amendment 3 still fell short of the margin. Estate Tax Changes for 2022.

Ad See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. That exemption would apply to the value of the property between 100000 and 150000.

For example lets say your estate is valued at 125 million in 2022. Major Tax Changes for 2022 You Need To Know 1. The exclusion amount is for 2022 is 1206.

Eastern as the first polls close in Indiana and Kentucky but the pace will really pick up. Erasmi Specializes in Estate Tax Planning and Preparation. NARAs FRCs will no longer accept paper files after December 31 2022 so the IRS reviewed its current policy regarding a 75-year retention period for estate tax returns and related gift tax.

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. For single taxpayers and married individuals filing separately the standard. This was anticipated to drop to 5 million adjusted for inflation as of January 1.

Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will. Each year there are changes to the tax code and during the last two tax years Congress voted to create new tax credits and extend several tax credits to help Americans with. Results will begin coming in at 6 pm.

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc

Estate And Inheritance Taxes Urban Institute

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Massachusetts Estate Tax Alert 2022 Youtube

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Gift Estate And Generation Skipping Transfer Tax Changes For 2022 Stanfield O Dell Tulsa Cpa Firm

The Senate Introduced A New Estate And Gift Tax Law Hartmann Doherty Rosa Berman Bulbulia

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

One More Scary Estate Tax Change And New Action Items For Many Affluent Taxpayers

Jun 21 The Administration S 2022 Proposed Estate And Gift Tax Changes Princeton Nj Patch

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Changes To Key Estate Tax Planning Numbers In 2022 Security Mutual Life Insurance Company Of New York